Africa's Digital Payment: A Case Study, Nigeria

Money

Nigeria, being the largest economy in Africa provides a test bed for developing Technological Solutions that will scale across the continent. With Over half of its 220 Million being un-banked, it is a quagmire. In 2021-2022 During the Global Pandemic, it was reported that to meet up with National Debt payment and Federal Government Allocations to State, The Country's Central Bank was forced to print money (Money printer goes Brrrrr), leading to a sharp fall of the National Currency, " Naira" from it's initial N450 to a Dollar down to N750 to a Dollar. This caused an Foreign Exchange (FX) squeeze that affected the Country's international trade and debt payment. Notably, there was no Foreign Exchange Reserves to pay Quartar Airline in September 2022, and so Nigerian Visa's were banned from entry into the UAE and all flights to and from Dubai we're suspended. This led the Central Bank to do two things

(1) Implement a Naira for Dollar scheme to raise FX :

Domicilliary account holders who deposited $1 would get an additional N5 upon conversion

(2) Change the Currency entirely:

The central bank opted to change the currency from old fiat notes to new refurbished fiat notes.

The adoption of these strategies led to a nationwide panic, long queues to withdraw fiat and exorbitant fees for fiat withdrawals. Getting the New Currency notes attract an extra charge of N200, so withdrawals of N10,000 would easily cost N5,000 in charges. Likewise the current internet banking solutions with Apps and USSD found their systems stress tested with long delays, app crashes and failed transactions.

Blockchain the solution?

In January 25th 2023, the central bank opened it's application to developers to apply to their Regulatory Sandbox and bring innovative ideas to improve the current financial system, after it's own failed attempt and a Digital Currency, the E-Naira (Built on IBM's hyperledger blockchain). Considering the Government's stand on Cryptocurrencies with it's outright ban in 2021, it becomes very confusing the actions for the central bank. Enthusiastic Crypto Developers flooded the CBN's twitter post shilling their blockchain solutions without understanding the environment and the regulatory framework of the Nigerian Financial System. Blockchain might not be the solution to cases like this, but proper leadership from the Central Bank Governor who has been shown to be quite partisan and an avid supporter of the current ruling party. His character being in doubt with multiple calls for his arrest made in the Nation's House of Senate in Q1 2023. His failure to qualify as a Presidential Candidate was one step in the eventual quagmire that has caused a nationwide cash crunch. Right Leadership, not Blockchain Technology is the solution. The regulatory framework of Cryptocurrencies like Bitcoin is unknown because while there is a Federal Ban on the Digital Currency, as a direct result of Bitcoin being used to fund the 2020 Police Brutality Protests in Nigeria, but State Legislation in southern states allow Crypto-Trading kioks to operate at a state level.

Nationwide Queues, Protests & Elections

As at the time of publishing this, there have been minor protests in Universities and States as a result of the Cash Crunch, Crippling inflation and Petrol Scarcity. There are nationwide queues for these amenities, and this has created the ideal conditions for a nationwide massive protest. With Presidential elections holding this Month, tensions are high, and emotions fill the air. Students and Soldiers fighting at Long ATM queues has become the National Topic. What happens from here? I'm not sure, rest assured, i will do my best to document it and update this blog with recent information as they unfold. It just might be the Financial version of the "Arab Spring" happening all over again.

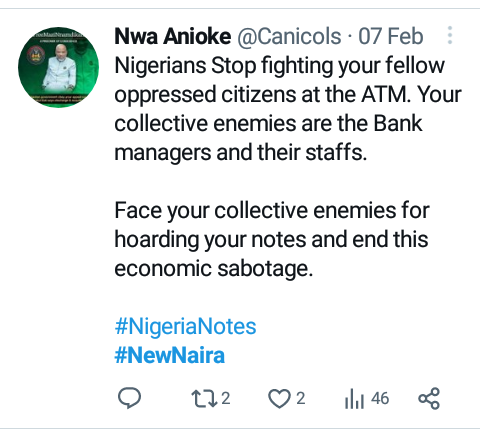

One such causal effect of the Elections is the reality of vote buying in Africa's most populous economy. Vote buying has been a reality of Electioneering in Nigerian politics, but the absence of Legal tender , barely 24 Days to the Elections and the use of BVAS Server Technology for voting, presents a new challenge for such corrupt practices. The have been noted cases of Bankers hoarding the New Naira notes to sell to Politicians for vote buying the the forthcoming 2023 Elections, and even cases of millions of Naira notes, getting hidden at warehouses because the holders of such funds do not wish to be ousted for Financial Crimes after making Large deposits of $300,000 worth of Naira into the Bank at a stretch.

Scarcity of the New Naira Notes

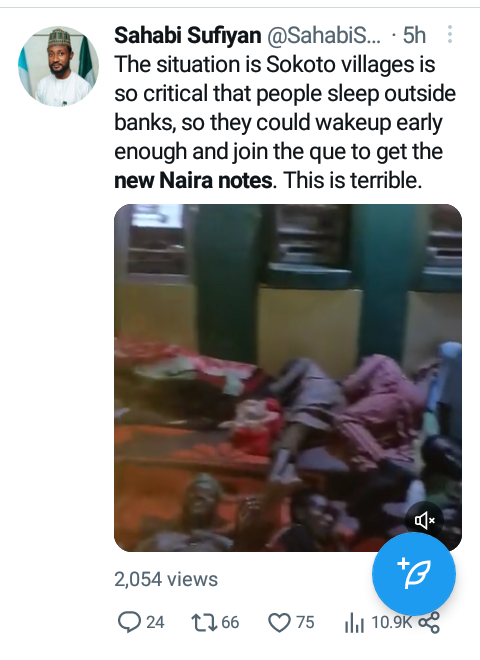

With a nationwide surcharge of between N200 and N400 (26 cents to 53 cents) on all fiat withdrawals outside crowded ATM's and at POS machines,the New Naira note has been scarce to find, up until 5 days before old notes officially cease to become legal tender, Old fiat notes are still being used in every day to day transactions

Unholy Political Alliances & Nepotism

One of the Presidential candidates for the 2023 Elections in Nigeria, a person of the Name Bola Ahmed Tinubu, whose origin has been shrouded in mystery and is an alleged Drug Barron and Political Godfather/Ex-Governor in charge of Lagos State, the commercial capital of Nigeria; his emergence as a Political candidate with the most skeletons in his closets was riveting and one of such skeletons just might be buying the new Naira notes off Bank Managers for electorial vote buying during this elections, riding on the banner of the incumbent Political Party, APC. Certain factions within the presidential circle are opposed to this mandate and so chose to frustrate a known billionaire's efforts by "creating new money", with the Central Bank Governor using a mandatory Financial Exercise as a political weapon. Also discovered was that the MD in-charge of the Printing press for the New Currency notes is none other than the brother of the First Lady of the Federal republic, thus adding credibility that this financial exercise is a political tussle between multiple factions in the Presidential Circle

CZ's Tweet

On the 7th of February 2023, CZ (The CEO of Binance, the Number 1 Crypto Exchange in Africa) tweeted "Cashless Policy" on a subtweet documenting how Nigeria has the highest google searches for "Bitcoin" globally. This was in reference to the Cashless Policy Infrastructure stress test that the central bank of Nigeria is conducting nationwide and how when contrasted with alternative financial networks like the Bitcoin Network and the Algorand Network, the amount of Transactions Per Second of the current local networks pale in comparison. One of these reasons is because each bank has to maintain it's own transaction network against down times and failed transactions, a dilemma that the Bitcoin network has long since solved with it's POW (Proof of Work) algorithm, likewise Algorand with it's PPOS algorithm (Pure Proof Of Stake)

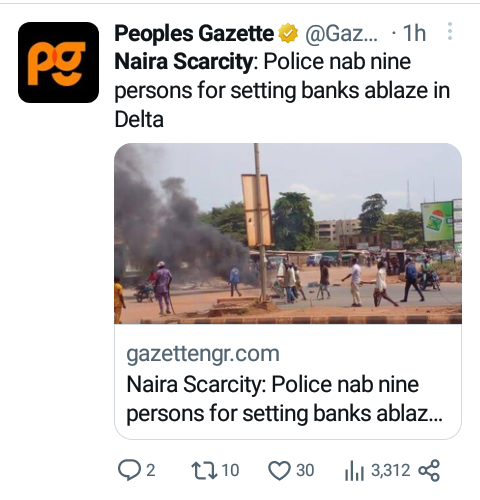

#NewNairaNotes, Bankers & Immolation

On the 15th of February 2023, The CBN announced a nationwide ban on the use of old naira notes a legal tender. Banks across the nation already having customers spending the Night at their doorsteps, following the CBN's directive, officially refused accepting old naira notes as deposits. This led to a ground halt of all transportation activities in cities across the nation as traders and transport workers refused accepting the old naira notes, and since the new naira notes aren't in circulation yet, all business activities came to a halt. Banks were burnt in multiple states and a Bank manager was immolated to death, the graphic video going viral on whatsapp. There has yet to be any update from the Central Bank or the Minister of Finance, with rumors of the Presidency postponing the deadlines on the legal tender of the old naira notes. The Central Bank Completely ignoring the Supreme Courts judgement to extend the deadline for accepting the old naira notes is the straw the straw that broke the Camel's back.

.

Return to Normalcy

It's been two weeks since the controversial presidential elections and there is a sense of normalcy returned. The supreme court having ruled to extend the use of the old naira notes as legal tender. Was it all for nothing? Apparently so.

Get Algodot

Algodot

Algorand Blockchain in Godot Game Engine

| Status | Canceled |

| Category | Tool |

| Author | Inhumanity Studios |

| Tags | algorand, blockchain, crypto, gamefi, Godot, plugin |

More posts

- Algod Node DocumentationOct 26, 2024

- Web Assembly support & Bleeding Edge UpdatesOct 25, 2024

- The U.S. Elections 2024: A Major Factor Moving Financial Markets, Market Reactio...Sep 28, 2024

- Version 0.2.1 UpdateMar 28, 2023

- Demo Wallet App ReleaseJan 23, 2023

- SmartContractsJan 01, 2023

- Windows Dependencies for OpenSSL *AddedDec 14, 2022

- AlgoWallet implementation releaseOct 31, 2022

Leave a comment

Log in with itch.io to leave a comment.